Environmental sustainability

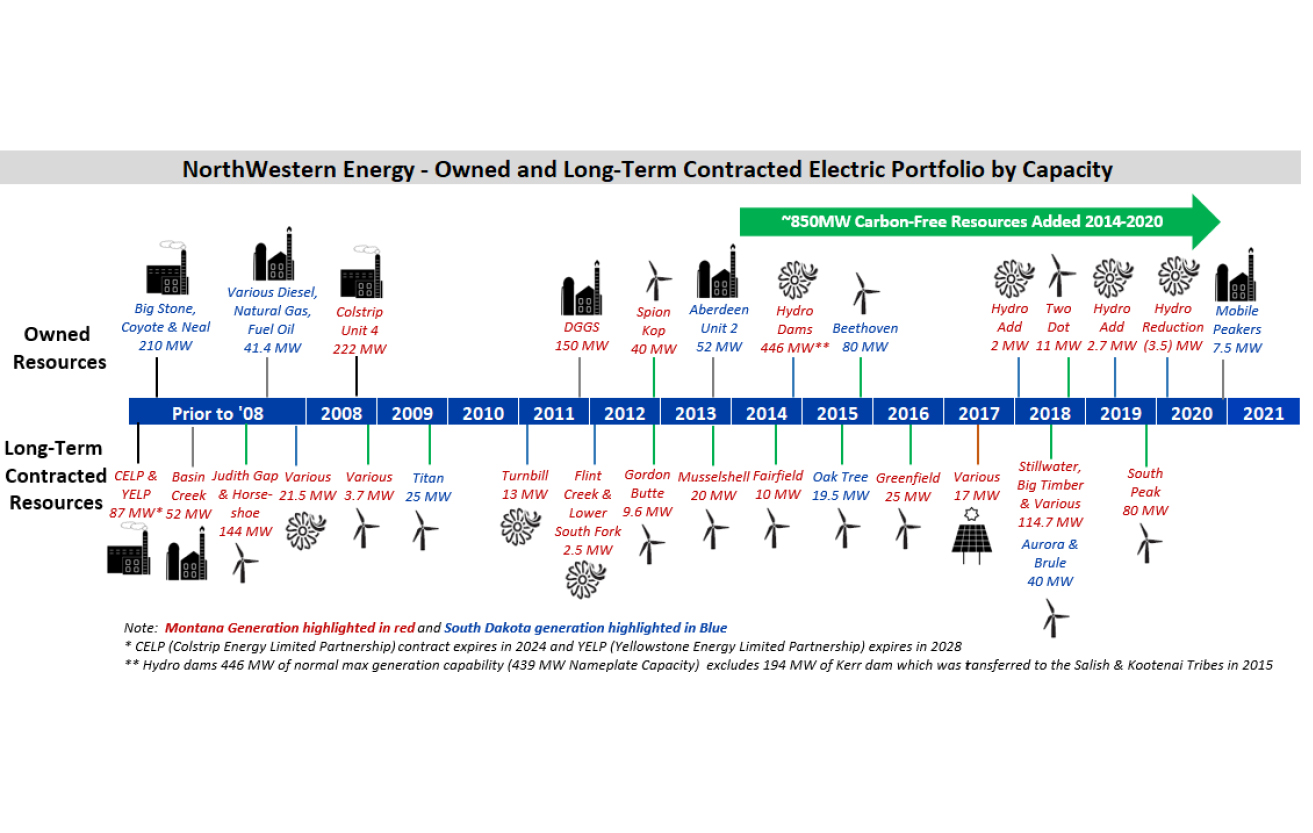

Environmental sustainability is at the foundation of all NorthWestern Energy’s energy resource decision‑making. However, we acknowledge the financial impact energy bills place on many of our customers and the significant amount of our low income customers’ disposable income that is devoted to energy costs. In Montana it’s estimated that about 25% of our customers are eligible for low income assistance and about half of those customers are living below the actual poverty level. Our resource acquisitions for the portfolio must continue to be focused on cost‑effectiveness in order to help provide affordable energy bills.

The reliability of our system is also paramount when planning and operating our power system, especially during critical weather when it’s bitterly cold and snowy or hot and sunny. From the generation data we collect for our system, we recognized the intermittent renewable generation, on our system, provides diminished capacity at times of key demand. In the winter, this diminished capacity frequently occurs for a large number of hours or even days. In fact, during our peak load day in February 2022, over 950MWs of power were imported onto our system since wind resources were largely unavailable. Even if battery storage would have been available to us, it would have only provided us with 4 hours of capacity. This is why long duration resources are important to our reliability.